GAAP concepts

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES AND BASIC CONCEPTS (GAAP)

1. If every accountant used his or her own rules for recording transactions, the financial statements would be useless in making comparisons.

2. Therefore, accountants have agreed to apply a common set of measurements principles (a common language) to record information for financial statements. Otherwise, decision makers could not use or compare financial statements.

GAAP :- The rules that govern accounting are called GAAP.

GAAP Overview

GAAP are the broad framework or the structure which is used to prepare financial statements of the companies. Like JAVA, C++ or HTML are used by software engineers to write computer programme, in the same manner accountants all over the world use a language- GAAP, to prepare financial statements. But there is one huge difference between Computer language and GAAP. Unlike a programmer who uses the same language irrespective of whether he is sitting in Silicon Valley or Shanghai, an accountant will use different reporting language in different jurisdiction because every country has different GAAP. For example, Account in India will use IGAAP (Generally Accepted Accounting Principles in India), the one sitting in Unite States will use US GAAP( Generally Accepted Accounting Principles In US), the one who is sitting in UK will use UK GAAP (Generally Accepted Accounting Principles in UK)in preparation of financial statement or books of account.

IFRS

International Financial Reporting Standard (IFRS) set common rules so that financial statements can be consistent , transparent and comparable around the world.

IFRS are issued by the International Accounting Standard Board (IASB).

IFRS were established to create a common accounting language, so that businesses and their financial statements can be consistent and reliable for the company and country to country.

When a company follow IFRS, it needs to provide a disclosure in the form of a note that it is complying with IFRS.

Sub- Disciplines within the Accounting Discipline

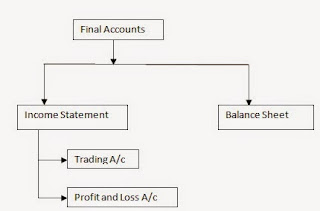

Financial Accounting - It assists keeping a systematic records of financial transactions the preparation and presentation of financial reports in order to arrive at a measure of organizational success and financial soundness.

Cost Accounting- It assists in analyzing the expenditure for ascertaining the cost of various products manufactured or services rendered by the firm and fixation of prices thereof. It also helps in controlling the cost and providing necessary costing information to management for decision making.

Management accounting- It deals with the provision of necessary accounting information to people within the organisation to enable them in decision- making, planning and controlling business operations. Management accounting draws the relevant information mainly from financial accounting and cost accounting which helps the management in budgeting, assessing profitability, taking pricing decisions, capex and so on.

Qualitative characteristics Of Accounting information

Reliability : The users must be able to depend on the information. A reliable information should be free from error and bias and faithfully represents what it meant to represents. To ensure reliability, the information disclosed must be credible, verifiable by independent parties use the same method of measuring, and be neutral and faithful

Relevance :To be relevant, information must be available in time, must help in prediction and feedback, and must influence the decisions of user by: helping them form prediction about the outcomes of past, present or future events; and confirming or correcting their past evaluations.

Understandability : The decision makers must interpret accounting information in the same sense as it is prepared and conveyed to them.

Comparability : It is not sufficient that the financial information is relevant and reliable at a particular time, in a particular circumstances or for a particular reporting entity. But it is important that the users of the general purpose financial reports are able to compare various aspects of an entity over different time periods and with other entities.

Thanks :

Priya Shrivastava

Akanksha Shrivastava

Very good👍

ReplyDeleteThanks

DeleteVery nice

ReplyDeleteThanks

DeleteHelpful👍

ReplyDeleteThanks

DeleteImportant points

ReplyDeleteYes .. thanks

DeleteHelpful and important notes

ReplyDeleteThanks

DeleteIt's very helpful for me thankyou

ReplyDeleteThanks keep reading I'll be posting ahead..

Delete