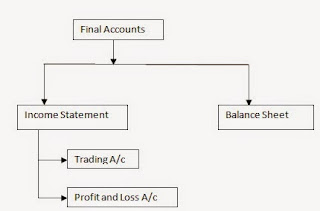

Final Accounts

Final Accounts gives an idea about the profitability and financial position of a business to its management,owners and other interested parties.Final accounts are prepared at the end of a fiscal year.

It is a combination of following statements-

Trading Account

Profit and Loss Account

Balance Sheet

1. Trading Account

It is prepared to find out the gross profit of the business for the particular accounting period.It is calculated by comparing the net sale with the cost of goods sold (COGS).

Gross Profit / Loss =Net Sale - COGS

Net Sale= Total sale ( cash sale + credit sale) - Sales returned/ Returned inward

Cost of Goods Sold= Opening Stock + Net Purchase + Direct expenses - Closing Stock

2. Profit and Loss Account

Profit and loss statement or Income statement is prepared to find out the net profit/ loss of the business for the particular accounting period.

It is calculated by comparing the Gross Profit / Loss with indirect income and expenses.

Net Profit / Loss= Gross Profit/ Loss + Indirect income-Indirect expenses.

3. Balance Sheet

It shows the position of the assets and liabilities of the business in the particular accounting period.The value of assets showing which we can realize from the market and the value of liabilities shows which we have to pay in future.

Features of Final Accounts-

1. To know the Profitability of the business.

2. Financial Strength

3. Forecasting and Budgeting

4.Communication

5. Growth rate of business

Thanks,

Akanksha Srivastava

Priya Shrivastava

It is a combination of following statements-

Trading Account

Profit and Loss Account

Balance Sheet

1. Trading Account

It is prepared to find out the gross profit of the business for the particular accounting period.It is calculated by comparing the net sale with the cost of goods sold (COGS).

Gross Profit / Loss =Net Sale - COGS

Net Sale= Total sale ( cash sale + credit sale) - Sales returned/ Returned inward

Cost of Goods Sold= Opening Stock + Net Purchase + Direct expenses - Closing Stock

2. Profit and Loss Account

Profit and loss statement or Income statement is prepared to find out the net profit/ loss of the business for the particular accounting period.

It is calculated by comparing the Gross Profit / Loss with indirect income and expenses.

Net Profit / Loss= Gross Profit/ Loss + Indirect income-Indirect expenses.

3. Balance Sheet

It shows the position of the assets and liabilities of the business in the particular accounting period.The value of assets showing which we can realize from the market and the value of liabilities shows which we have to pay in future.

Features of Final Accounts-

1. To know the Profitability of the business.

2. Financial Strength

3. Forecasting and Budgeting

4.Communication

5. Growth rate of business

Thanks,

Akanksha Srivastava

Priya Shrivastava

Very informative...looking forward for more.....

ReplyDeleteWell explained 😊😊

ReplyDeleteReally helpful

ReplyDeleteThnks.. explained well.. very halpful

ReplyDelete👍

well written 👍

ReplyDeleteThank u for t explaination ���� great hard work ...keep it up ����

ReplyDelete